“House of Decision”: How The Sun Lakes Charitable Trust Funneled $50,000 Into A Millionaire’s Pocket

.

5/5/19 – What you are about to read will show, without a doubt, that the Sun Lakes Charitable Trust has funneled about $50,000 into the pockets of a shady millionaire businessman, who for 10 years solicited charitable donations by masquerading as a charity, when in reality he was operating a registered commercial for-profit business.

.

MEET MILLIONAIRE BJORN “BJ” STAVNESS, DOING BUSINESS AS “HOUSE OF DECISION” (2007-2017)

Falsely pretended his commercial business was a charity : Cherry Valley millionaire Bjorn “BJ” Stavness

Bjorn “BJ” Stavness is a millionaire businessman living in Cherry Valley. Stavness seems to be no stranger when it comes to making money: Riverside County records show that he and his wife own approximately $1.3 million worth of real estate in the area, including three homes (see a partial list here).

To say that BJ Stavness is politically connected is a vast understatement. His connections include many local corrupt figures, for example former Supervisor Marion Ashley. Stavness is also friends with former Banning Mayor Debbie Franklin, who herself was investigated by the FBI over suspicion of running a charity scam. Stavness also maintains intimate ties to Beaumont councilman Mike Lara, who is also a Riverside County Building and Safety official. Lara went out of his way to give Stavness a building permit in violation of County policy, when there was an active code enforcement case pending against his property in Cherry Valley.

Other than living a cushy millionaire’s life, BJ Stavness runs a company named Lodestar Light LLC, which is in the Solar Power business (see filing). And, you probably guessed it, BJ Stavness is also in the “Jesus Business” – he runs a religious organization named “Pure Rock Christian Fellowship” (see filing), which has tax exempt status and therewith enables him to keep part of his financial dealings from public scrutiny.

However, there are a few problems with BJ’s so-called “church”: it appears to have no place of worship, no website, no signage, no membership, no regular published congregations and no published religious services. In other words, this appears to be a fake church, presumably set up to take advantage of tax-exemptions.

According to former Banning council member Jerry Westholder, BJ Stavness’ father was a minister who was accused of stealing from his church. Is this how BJ Stavness learned how to amass his substantial fortune? They say the apple does not fall far from the tree. Let’s just leave it at that …..

.

.

“HOUSE OF DECISION” – A “HOUSE OF DECEPTION”?

It appears that in this particular case, Stavness’ fake “church” was NOT used to funnel Sun Lakes charitable donations into his pockets.

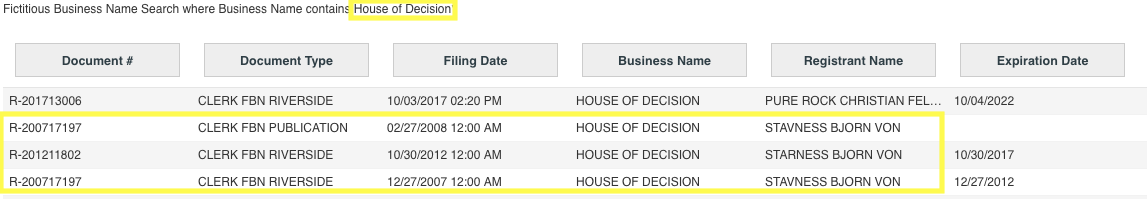

But according to public filings, BJ Stavness used yet another business entity for this purpose: the Riverside Recorder’s Office shows that between 2007 and 2017, Stavness registered the name “House of Decision” three times as his personal business – dba. Each fictitious business name filing is good for 5 years.

.

.

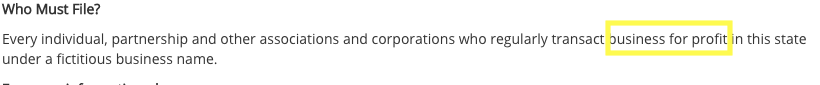

We now know that “House of Decision” was the registered fictitious business name (dba) of Bjorn “BJ” Stavness. The Riverside County Recorder explains who must file such a dba:

.

.

As we can see, individuals that regularly transact business for profit must file a dba.

These important public records shows us, that at least during the 10 years in question (2007-2017), “House of Decision” by definition was NOT a charity – because it belonged to an individual who registered it as his for-profit business.

Needless to say that, under IRS rules, individuals can never carry charitable status. This is the reason why the IRS roster of eligible charities does neither show a “House of Decision” , nor a BJ Stavness as being an eligible 501,c,3 .

Under the law, BJ Stavness’ “House of Decision” was not allowed to solicit or receive any charitable funds whatsoever.

.

.

ROGUE OPERATION

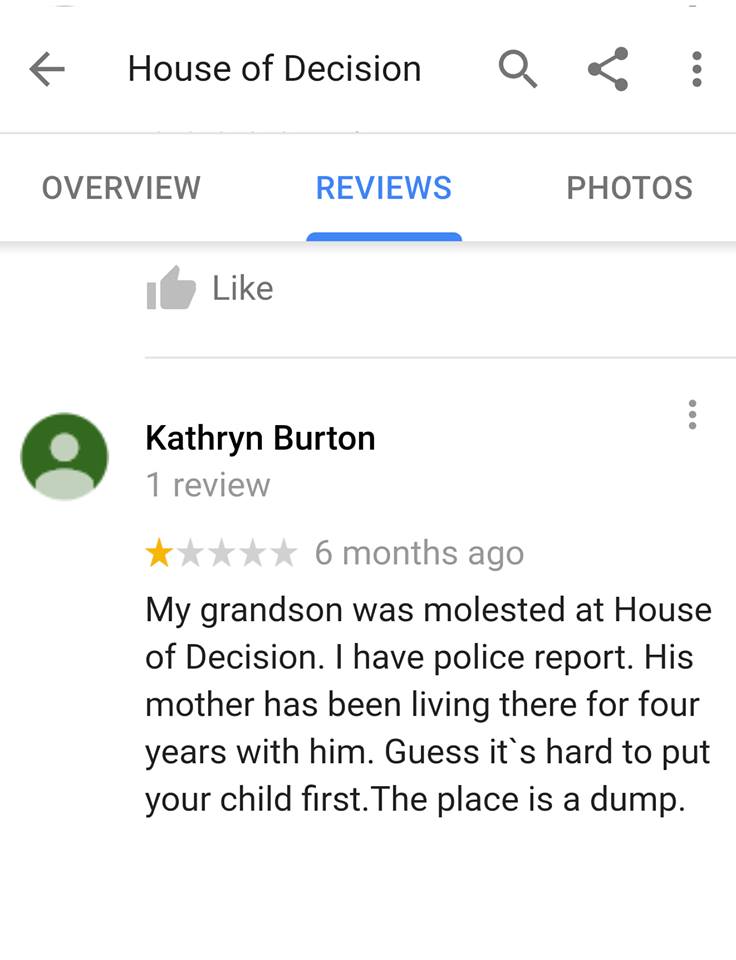

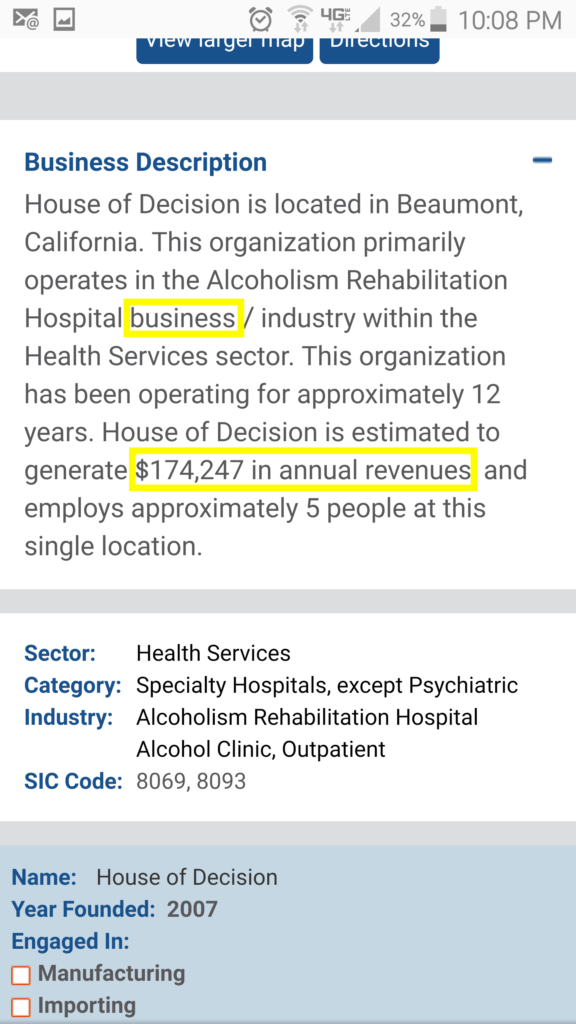

Aside from the above, BJ’s “House of Decision” appears to have anything but a stellar reputation.

Aside from the above, BJ’s “House of Decision” appears to have anything but a stellar reputation.

It operates a commercial (for profit) rehabilitation facility in Cherry Valley (see business profile on left). According to eye witness reports, up to 4 people are crammed into a single bedroom, presumably so cost is minimized and profits can be maximized.

The entity conducts its business in a residential area. County permits were never obtained. This creates an enormous burden for many residential neighbors, who have to deal with the fallout from BJ’s rogue operation, which includes : people constantly coming and going at the facility, night and day, 24-7-365. At ![]() times, loud noises can be heard, even late at night. Trash is piling up. Golf balls fly into neighbors’ yards, preventing horse owners from using their land to graze their animals, in fear of golfballs hitting their animals, or the animals eating them.

times, loud noises can be heard, even late at night. Trash is piling up. Golf balls fly into neighbors’ yards, preventing horse owners from using their land to graze their animals, in fear of golfballs hitting their animals, or the animals eating them.

Because of its lawless conduct, the facility has been subject to countless code enforcement complaints, most of which ended up being “crushed” due to Stavness’ tight connections with corrupt County officials.

To make matters worse, “House of Decision” has also been accused of at least one incident of child molestation (see the disturbing statement by Cherry Valley resident Kathryn Burton, above right).

.

.

$50,000 FUNNELED INTO AN INDIVIDUAL’S POCKET

The ugly faces behind all Sun Lakes corruption: George and Sandra Moyer

We now know that, year in and year out, for 10 years, the Trust is on record giving large sums of money to a religious con-artist and apparent charity scammer.

We now know that, year in and year out, for 10 years, the Trust is on record giving large sums of money to a religious con-artist and apparent charity scammer.

For all these years, millionaire businessman BJ Stavness solicited charitable funds as an individual, under his personal, for profit business, “House of Decision”, while masquerading as a charity. About $50,000 went into his pockets this way – and counting (view payment details)

Before distributing charitable funds, the Sun Lakes Charitable Trust had an obligation to check public record for eligibility of its recipients. They failed to do so when they gave $50,000 to a publicly registered private, for profit businessman, in what appears to be clear violation of non-profit laws.

And along the way, this also violated the trust of all Sun Lakes donors – all of them got scammed. The funneling of charity money into the pockets of a single individual is not only unlawful, but may also constitute criminal fraud on  the donors.

the donors.

But apparently this did not faze any Sun Lakes Trust Directors, headed by Sun Lakes’ notorious power couple, the almighty Moyers.

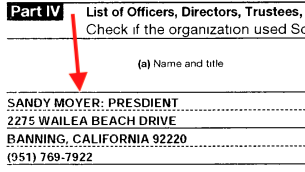

As we had mentioned before, George Moyer keeps tight control over the organization through his wife Sandra, who has been listed as President in the Trust’s public filings. Both Moyers also serve as chairpersons of Sun Lakes Charity Week.

.

.

WHY WERE THESE PAYMENTS MADE? WERE THERE KICKBACKS?

We have to ask : why were these payments made, year in and year out? It defies logic and common sense for the Trust to give so much money to an ineligible individual, year after year.

At the end of the day, we can only come up with two reasons why these payments could have been made: they were either made because of stupidity or incompetence by Trust officials – or they were made because there was a kickback received by someone (i.e. corruption).

Knowing how George Moyer and his crew of straw men operate, we can pretty much exclude the possibility that this was just an innocent $50,000 mistake. Anyone who knows George Moyer knows that he is much too shrewd to make stupid $50,000 mistakes. That just does not happen.

Therefore, this leaves us with the only one other possibility : this may have been done intentionally, presumably for a kickback. But since kickbacks are almost always paid in untraceable form, i.e. cash, we obviously can’t say with certainty that this was the case – until of course another whistleblower comes forward.

What we do know for sure at this point is, that something here smells really, really bad!

.

IRS SUSPENSION NEXT ?

Distributing charitable assets to non-charitable recipients is against the law and could lead to an immediate suspension of the tax exempt status of the Sun Lakes Charitable Trust. Since the non-charitable amount in question is so large, it is possible that the IRS may revoke their charitable status altogether.

Distributing charitable assets to non-charitable recipients is against the law and could lead to an immediate suspension of the tax exempt status of the Sun Lakes Charitable Trust. Since the non-charitable amount in question is so large, it is possible that the IRS may revoke their charitable status altogether.

This will mean that any donations to the Trust could no longer be tax deductible. It may also mean that the individuals running the Sun Lakes Charitable Trust (the Moyers, Kealy etc.) will be held liable by the IRS for income tax on the donations the Trust has received.

.

.

LESSON LEARNED : AVOID DONATING TO THE MOYER CONTROLLED SUN LAKES CHARITABLE TRUST

The above should serve as a warning to all Sun Lakers : do not donate to the Sun Lakes Charitable Trust. As you can see, your money may end up in the pockets of charity scammers.

Besides, why would anyone want to donate to this organization, which does no charitable work of its own? They merely act as the middleman, who takes a cut for their “expenses”.

There are much better options for Sun Lakers than to donate to a Charitable Trust: you can directly donate to a charity of your choice – for example Carol’s Kitchen. This legitimate charity is trying to recover from the horrible theft of almost $350,000, orchestrated by predatory associates of none other than Banning Mayor Art Welch (please take the time to read the forensic audit).

There are much better options for Sun Lakers than to donate to a Charitable Trust: you can directly donate to a charity of your choice – for example Carol’s Kitchen. This legitimate charity is trying to recover from the horrible theft of almost $350,000, orchestrated by predatory associates of none other than Banning Mayor Art Welch (please take the time to read the forensic audit).

Aside from Carol’s Kitchen, we are happy to report that since our previous article, Tender Loving Critters Animal Rescue is now current with the Attorney General, and is eligible to receive your donations for the wonderful work they do for Banning’s animals.

.

.

CONCLUSION

“House of Decision“ has turned out to be a huge “House of Deception”. And like with every deception, the house of cards is eventually coming down. It is now clear that charitable donations were funneled into a registered, commercial for-profit business run by a millionaire, who masqueraded as a charity.

This circumstance has now severely damaged the credibility of the Sun Lakes Charitable Trust – possibly beyond repair. The almighty Moyers are realizing this. They realize that they cannot disprove our diligent research, so they attack the messenger and even vilify free speech. They are terrified that you may learn the ugly truth about them and their Sun Lakes Charitable Trust.

You see, the Moyers can sense that once their Charitable Trust goes down, it will take them down with it. And this frightens them beyond measure. But at the end of the day, their inevitable downfall may be the best that could ever happen to the community of Sun Lakes – and Banning as a whole.

.

If you would like to comment or discuss this – or any other – article, please visit us on FACEBOOK

If you would like to comment or discuss this – or any other – article, please visit us on FACEBOOK